From From Zero Hedge

When mortgage rates were “only” 5 percent a little more than a month ago, we shared a number of heartbreaking anecdotes from real estate agents and business leaders who confirmed our worst suspicions: US housing was imploding… fast. Subsequent observations only served to bolster this dire assessment of the situation of the asset class that is most popular among the US middle class.

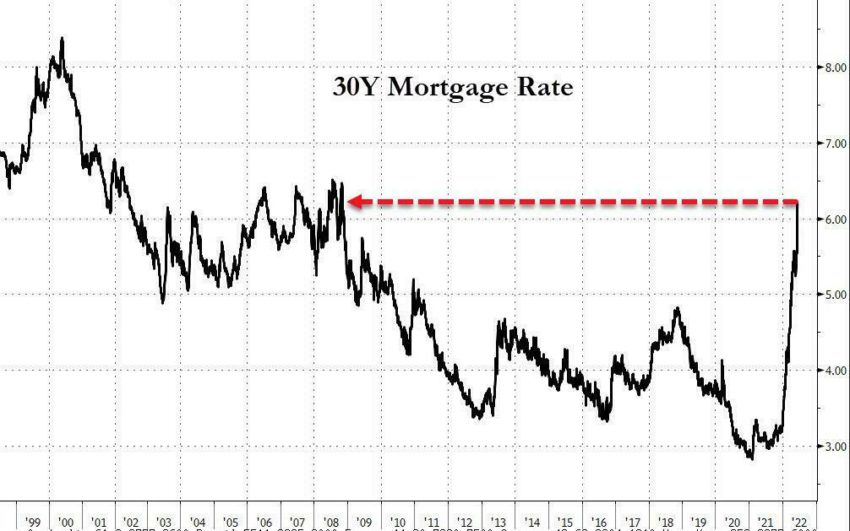

With 30Y mortgage rates surging at the quickest rate on record to above 6 percent, or levels last seen right before the housing bubble burst, things have gone from bad to catastrophic this week. creating the most overpriced housing in history…

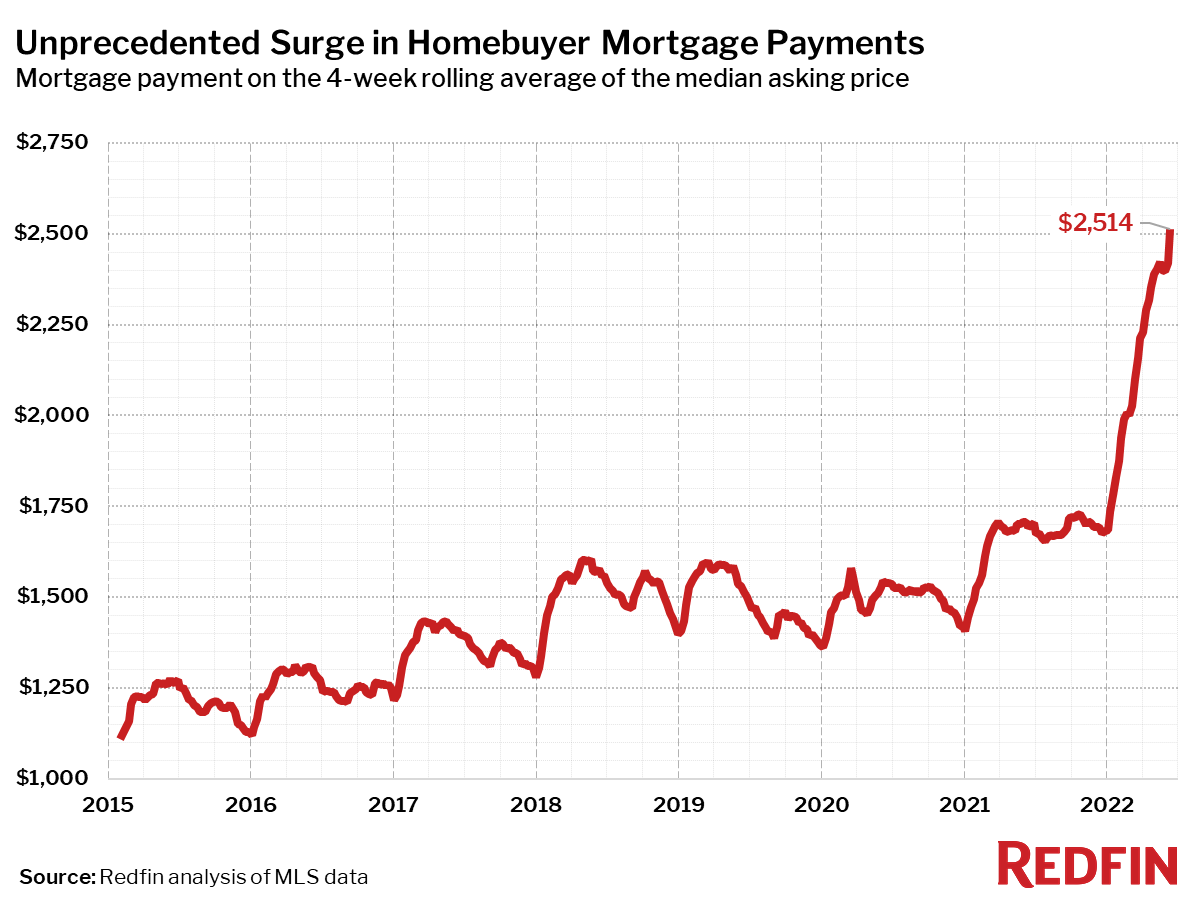

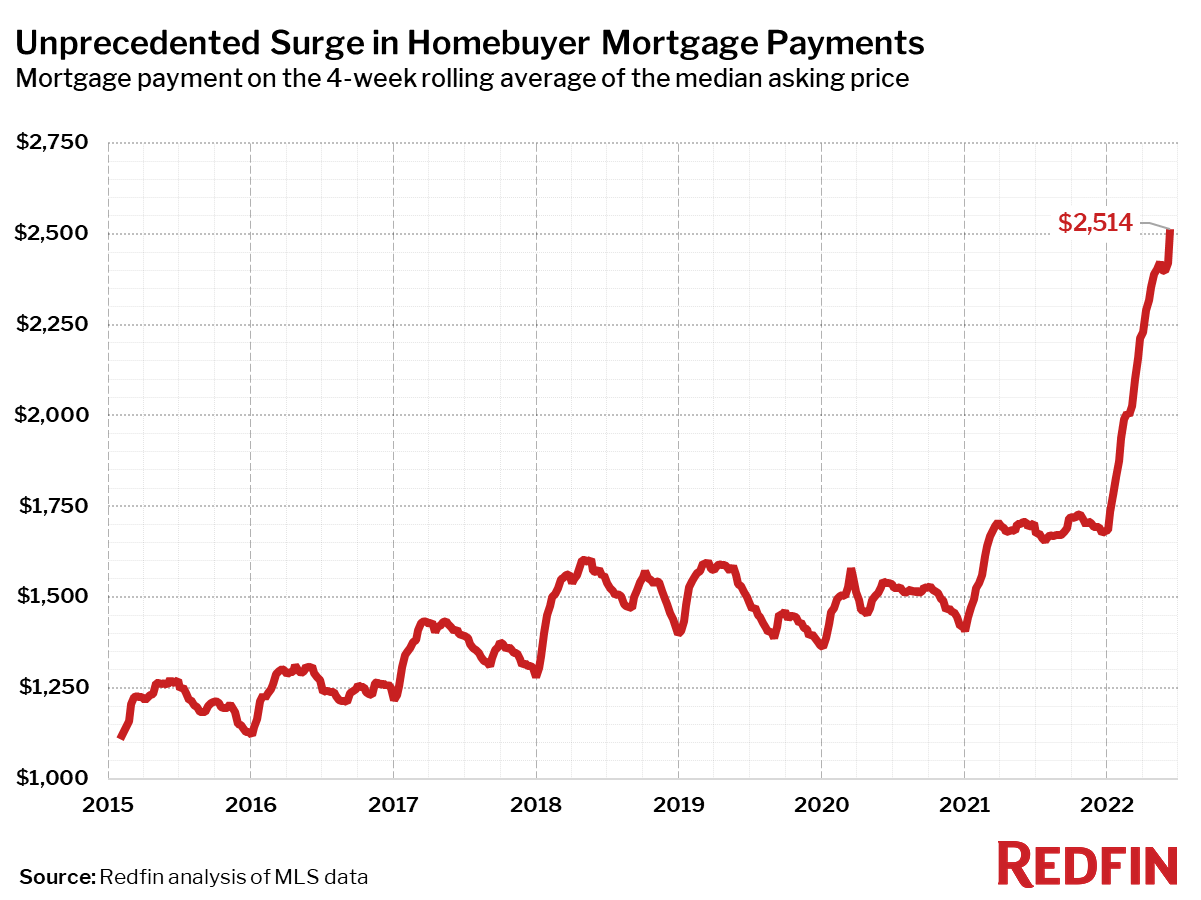

…. sending the average mortgage payment on a median mortgage up by almost $800 in just the past 6 months……

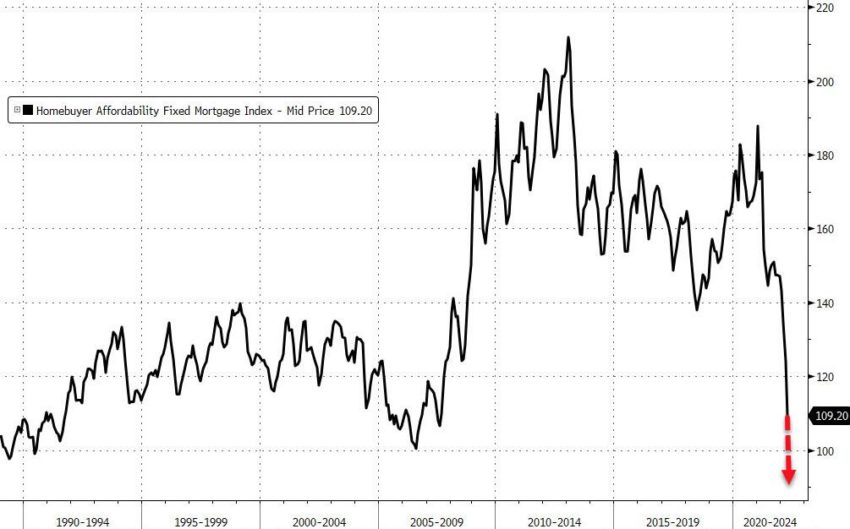

making housing the most unaffordable in history…

causing the longest negative streak since 2010 and send new home sales plummeting at the fastest rate since the peak of the credit crisis.

… and homeownership sentiment is at its lowest point in decades.

Which takes us to RedFin’s most recent home market summaries, which are not pleasant to look at.

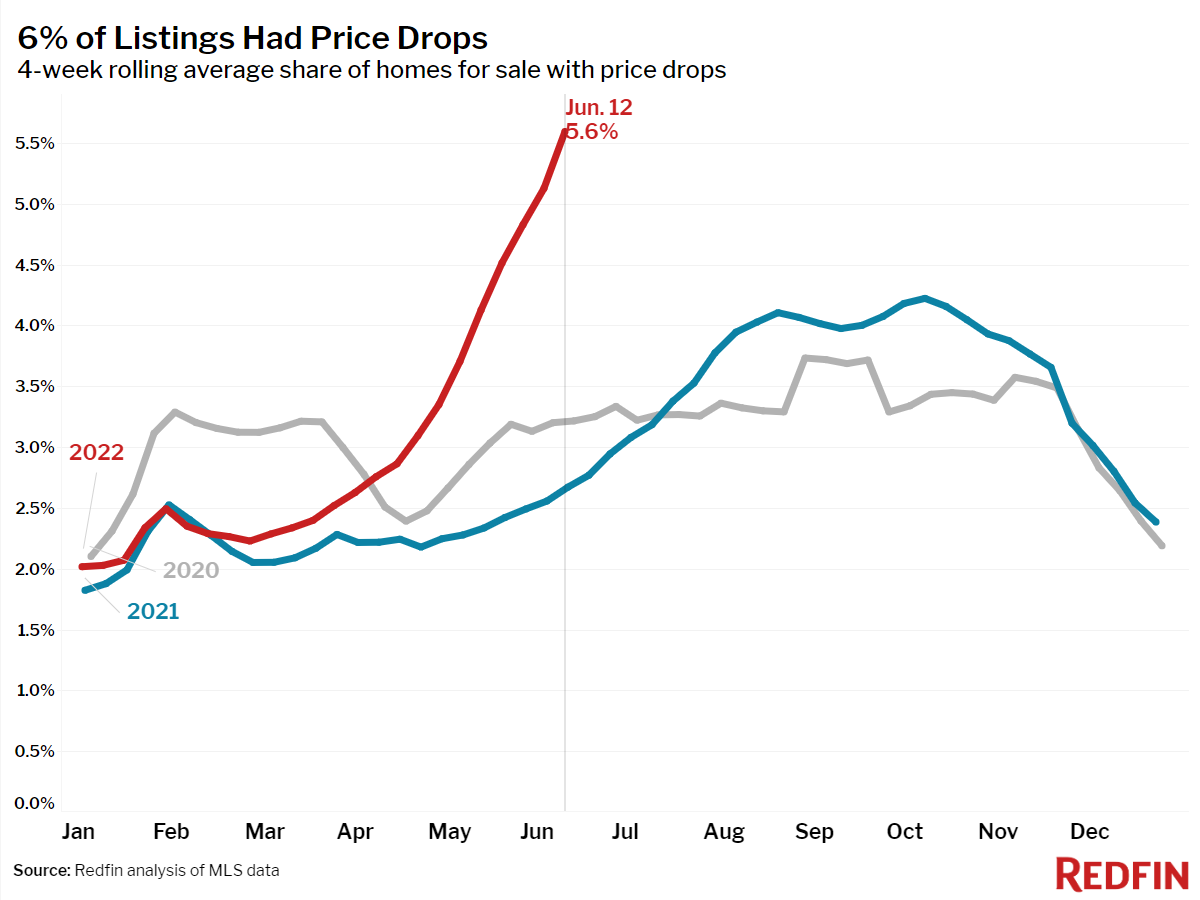

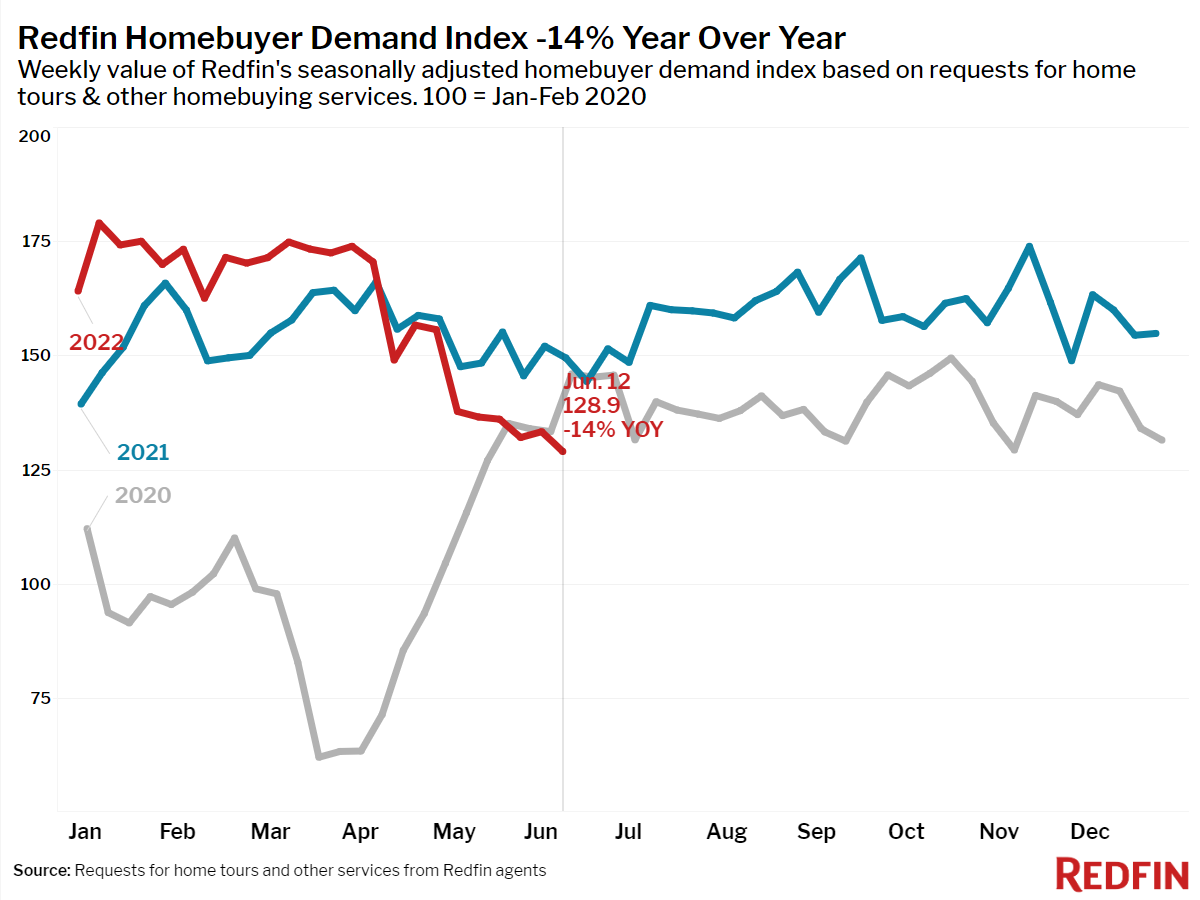

According to Redfin, the highest percentage of sellers ever reduced their list price during the four weeks ending June 12 as mortgage rates shot up to levels not seen since 2008, collapsing the pool of potential home buyers. The first chart illustrates how the period of unheard-of price increases for homes and a uniformly sellers market has turned around.

Redfin reports that the proportion of new-construction listings with price reductions has quadrupled in the metro areas of Austin, Texas, and Nashville, Tennessee, compared to last year. They more than doubled in Tampa, Florida, and tripled in Phoenix.

“We are in a different place — the builder can no longer specify a price and say, “Pay it or go along,” said Houston real estate agent Nicole Freer, who has reduced rates on properties she advertises for builders by $2,000 to $20,000 “They’re telling us that our management have given us permission to negotiate once more.”

The cost of owning a home has never been higher despite the obvious flaws in the housing market. The typical buyer looking at a 30-year fixed-rate mortgage is looking at a monthly payment of $2,514, up from $1,692 a year ago due to pricing delays!

However, individuals who continue to buy may find less competition from other buyers.

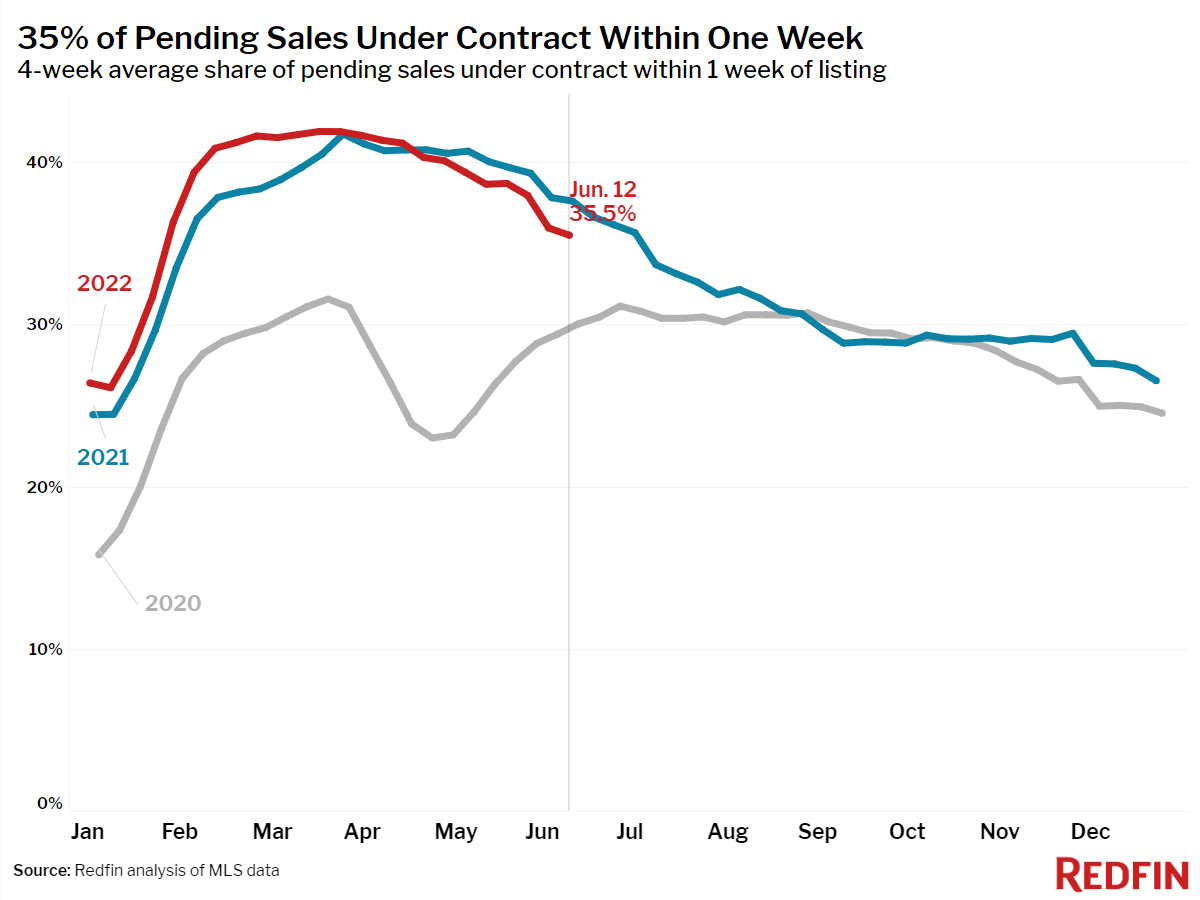

Compared to last year, when homes would often go under contract within a week, homes are now more likely to linger on the market for a few weeks.

And less frequently than earlier in the spring are home prices being bid up.

According to Taylor Marr, deputy chief economist at Redfin, “the housing market isn’t collapsing; rather, it is experiencing a hangover as it comes down from an unsustainable high.” “Housing demand has already decreased noticeably to the point where the sector is now starting to see layoffs. Rate increases this week will make it harder for buyers to afford homes, perhaps pricing out more people. More homeowners will probably choose to remain in their present homes now that the mortgage rate on a new home is much higher than their current one, even if many home sellers are already lowering their asking prices.”

Real estate agent James Cappello of Redfin Bay Area said, “If it weren’t for the rise in mortgage rates, the home market would still be in a boom right now.” “Homebuyer demand was still very robust as recently as February, but rates are really making it difficult. Many people have fled the market as the rate suddenly increased from 3 to approximately 6 percent.

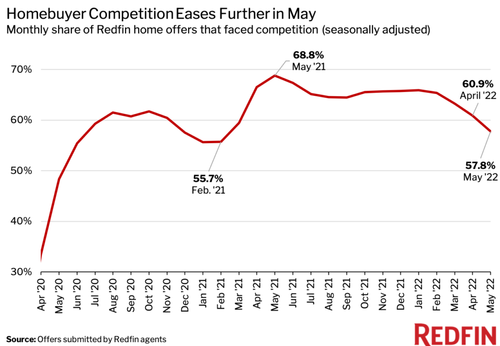

And there’s more. Redfin then states that the amount of competition for the available inventory has dropped to its lowest level since February 2021, with 57.8 percent of home offers written by Redfin agents seeing competition on a seasonally adjusted basis in May. This represents the fourth straight month of declines, falling significantly from a revised rate of 60.9 percent one month earlier and a pandemic peak of 68.8 percent one year earlier. The bidding-war rate in May was 60.8 percent on an unadjusted basis, down from 67.8 percent in April and 71.8 percent in May 2021.

The average home in a bidding war received 5.3 offers in May, down from 6.8 in April and 7.4 in May 2021, as a result of lessening competition.

According to Jennifer Bowers, a Redfin real estate agent in Nashville, “homes are currently getting one to three offers, compared with five to ten two months ago and as many as 25 to 30 six months ago.”

Additionally, offers aren’t coming in as high above the advertised price as they did in the past. A three-bedroom, three-bathroom house in a really cute area was just listed by me for $399,900. Three months ago, the buyer probably would have paid $60,000 over asking and waived the inspection, but it ended up going under contract for $12,000 more than the list price with an inspection.

Given the foregoing, it comes as no surprise that today Bloomberg reports that “The sector was caught off guard when demand in many areas quickly decreased due to the fastest-rising mortgage rates in decades. The inventories of the builders who were artificially restricting sales and selling auction houses to the highest bidder must now be moved.”

It’s a part of a swift market shift in the US housing sector brought on by the Federal Reserve’s sharp interest rate increases to control inflation, which have driven up the cost of mortgages to their highest level since 2008 and put a strain on buyers whose affordability limits were already being tested. Just this week, brokerages Compass and Redfin said they would lay off employees as a result of economic statistics showing that housing starts have fallen to their lowest level in more than a year, homebuilder morale is at a two-year low, and homebuyer sentiment is at its lowest point ever.

The Supercomposite Homebuilding Index has fallen 42 percent this year through yesterday, nearly double the 23 percent decline in the S&P 500, indicating that the market has taken notice of the housing crisis. Share prices for builders have also fallen.

Builders are currently coping with a combination of declining demand and high material and labor prices. Last year, they had so much power that customers would wait overnight in line for homes they would meter out. They are eager to finalize contracts before homebuyers pull back even further because the Fed has hinted at additional significant rate increases in the coming months.

Because homes are taking so long to build in Sarasota, Florida, prospective purchasers are holding off, according to Donnette Herring, a Realtor with Keller Williams. It’s impossible to predict where borrowing costs will stand by the time the homes are finished.

They get anxious about inflation, Herring said.

It’s still early to see signs of a shift. The situation varies from area to region and even between subdivisions, with many still experiencing significant supply shortages. In addition, many builders are providing incentives like free renovations, funds for closing costs, and reduced mortgage rates rather than lowering prices. However, according to Ali Wolf, chief economist at Zonda, the market is moving quickly. Price reductions were first reported to her company, which monitors new development, in late May or early June.

The builders who are offering lower pricing were also the ones who hiked prices the most over the previous six to twelve months, according to her.

Many of those are in areas that were popular picks for pandemic migrants who were leaving expensive areas in search of greater space and less expensive housing. According to Redfin data, from May 9 to June 5, 22% of new house listings in the Phoenix metropolitan region saw price reductions, up from 7% a year earlier. In Austin, it increased to 13 percent from just 3 percent, while in Tampa, it increased from 9 percent to 21 percent.

According to listings in Florida, Texas, and Arizona that are publicly available on sites like Redfin and Realtor.com, the cuts have come from both small private builders and large public ones, like D.R. Horton, Meritage Homes, and Lennar. 146 completed homes in Arizona are displayed on a PulteGroup website, majority of which have price reductions. Vice President of Investor Relations Jim Zeumer said those seemed to be typical incentives used to sell completed or soon-to-be-completed spec homes, which are those developed without a buyer in place.

We usually have one or two finished specs in a community, but Zeumer added that we employ incentives to control inventory levels over the course of a community.

Due to the unpredictability of material and labor prices during the recent boom, many builders held off on enabling buyers to purchase homes until they were almost finished. They are therefore faced with an abundance of new homes that need to be matched with purchasers.

According to local realtor Freer, the fastest-growing communities farthest from the city, such Conroe to the north and Alvin to the south, are experiencing the most cooling. She is now hearing from builders who previously only took orders for “dirt,” or unfinished homes.

About 70% of her 120 listings for builders currently have cuts, according to the realtor. It will quickly reach 100%.

Contract cancellation rates are an important measure to keep an eye on, according to Rick Palacios, research director at John Burns Real Estate Consulting in Irvine, California. According to a poll of builders conducted by his company, it increased from 6.6 percent in April to almost 9 percent nationwide in May. That’s still below the 16 percent rate that followed the initial pandemic lockdowns two years ago.

No matter how you slice and dice the statistics, more supply is on the way, according to Palacios. “Builders are attempting to beat that wave. The economic slowdown and an increase in supplies could come as a double punch. The best recipe for selling homes is not that one.