From NewsWars.com

The Biden administration ran a $1.695 trillion budget deficit in fiscal 2023. It was the third-largest deficit in US history. The only time the US government ran bigger deficits was during the COVID years of 2020 and 2021.

The government closed out the year with a $170.98 billion deficit in September, according to the final Monthly Treasury Statement of the fiscal year. That was more than double the projection.

The deficit would have been even higher had it not been for an accounting move in August that reversed student loan forgiveness.

Last year, the Treasury expensed $333.65 trillion for the student loan forgiveness plan signed by President Biden. When the Supreme Court struck the scheme down, the Treasury had to reverse that expense. That means the actual shortfall was more than $2 trillion this year — $3 trillion higher than the official numbers.

The 2023 budget shortfall was bigger than any run during the Obama administration during the Great Recession, and yet this economy is supposedly strong. Typically, strong economies result in smaller deficits as tax revenue rises.

That was not the case in fiscal 2023. Federal Receipts fell by 9.3% to $4.44 trillion.

The federal government enjoyed a revenue windfall in fiscal 2022. According to a Tax Foundation analysis of Congressional Budget Office data, federal tax collections were up 21%. Tax collections also came in at a multi-decade high of 19.6% as a share of GDP. But CBO analysts warned it won’t last. And government tax revenue will decline even faster as the economy spins into a recession.

Treasury Secretary Janet Yellen was quick to blame falling tax receipts for the big deficit and said it underscores “the importance of President Biden’s enacted and proposed policies to reform the tax system.

But the big problem is on the spending side of the ledger. Strong receipts last year papered over the spending problem.

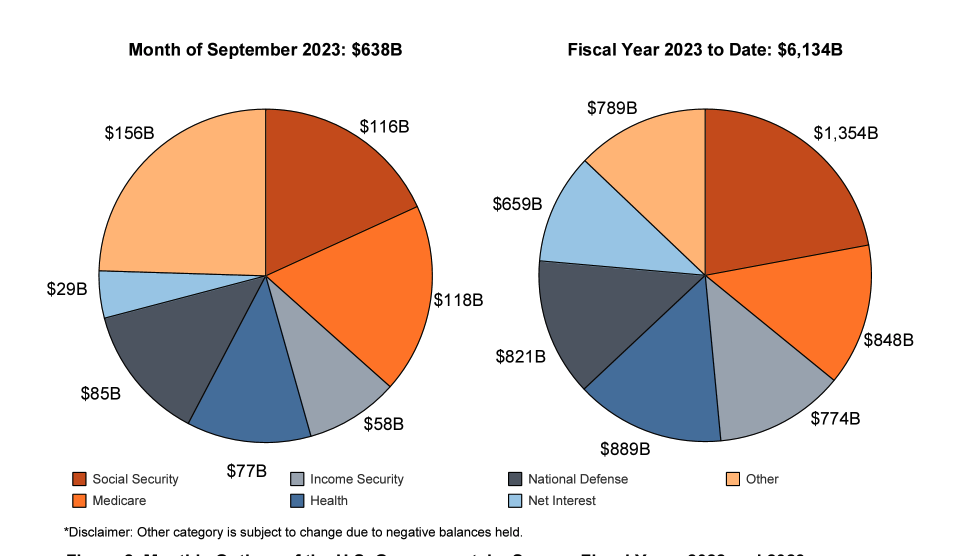

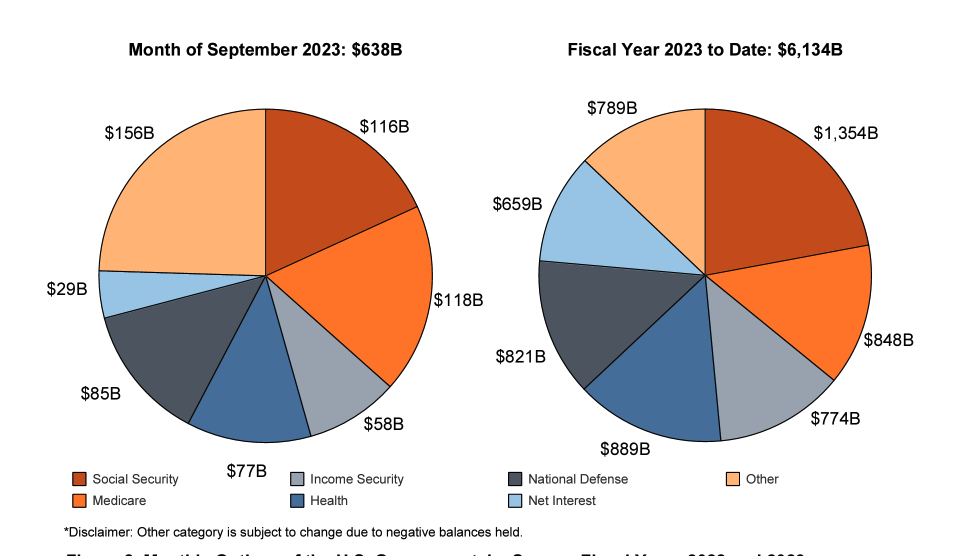

The US government blew through $6.13 trillion in fiscal 2023. That was down slightly from last year’s total expenditures, but the numbers were skewed by student loan forgiveness accounting. If you factor out the reversal of student loan forgiveness, the Biden administration spent $6.46 trillion in fiscal 2023, an 8.8% year-over-year increase in actual spending.

The Biden administration already wants more money. The president recently proposed a $100 billion aid package for Israel, Ukraine and other “national security” priorities.

Keep in mind that the feds now have a credit card with no limit.

And despite the caterwauling of a few Republicans, virtually nobody in Washington DC is interested in addressing this spending problem.

The fundamental issue wasn’t that the US government didn’t have enough money. The fundamental problem was, and still is, that the US government spends too much money. Despite the pretend spending cuts, the debt ceiling deal didn’t address that problem. Even with the new plan in place, spending will go up. And it’s already historically high. That means big budget deficits will continue and the national debt will mount.

Meanwhile, the national debt blew past $33 trillion on Sept. 15. Just 20 days later, it pushed about $33.5 trillion. In other words, the Biden administration added half a trillion dollars to the debt in just 20 days.

It’s easy to finger-point at President Biden and blame him for the spending problem, but this isn’t exclusive to the current administration. Trump also borrowed and spent like the proverbial drunken sailor.

To put the deficit in perspective, prior to the pandemic, the US government had only run deficits over $1 trillion four times — all in the aftermath of the 2008 financial crisis. Trump almost hit the $1 trillion mark in 2019 and was on pace to run a trillion-dollar deficit prior to the pandemic when the US supposedly enjoyed the “best economy” ever. The economic catastrophe caused by the government’s response to COVID-19 gave policymakers an excuse to spend with no questions asked. Now the Biden administration has settled into the new status quo – running ’08 financial crisis-like deficits every single year.

THE BIGGER PROBLEM

This rapid increase in the national debt is happening during a time of sharply rising interest rates. This is a big problem for a government that primarily depends on borrowing to pay its bills.

Interest expense rose by 23% to $879 billion. Net interest, excluding intragovernmental transfers to trust funds, rose by 39% to $659 billion. Both of those numbers broke records.

Gross interest payments amounted to 3.28% as a share of gross domestic product, according to a Treasury Department official quoted by Reuters. That was the highest since 2001. The net share of interest expense came in at 2.45%, the highest since 1998.

The average interest rate on the debt is now at the highest level since 2011, coming in at 2.92% as of the end of August. But that’s still relatively low, and the debt is more than double what it was back in the good ol’ days of 2011.

Meanwhile, the average interest rate is poised to climb rapidly. A lot of the debt currently on the books was financed at very low rates before the Federal Reserve started its hiking cycle. Every month, some of that super-low-yielding paper matures and has to be replaced by bonds yielding much higher rates. That means interest payments will quickly climb much higher unless rates fall.

To give you an idea of where we’re heading, T-bills currently yield about 5.5%, the two-year yield is over 5% and the 10-year currently yields close to 5%.

Rising interest rates drove interest payments to over 35% as a percentage of total tax receipts. In other words, the government is already paying more than a third of the taxes it collects on interest expense.

If interest rates remain elevated, or continue rising, interest expenses could climb rapidly into the top three federal expenses. (You can read a more in-depth analysis of the national debt HERE.)

Peter Schiff provided some context in a tweet.

US debt was 119% of GDP in 1946. Budget surpluses in 4 of the next 5 years reduced it to 68% by 1953, the largest was 4.3% in 1948, the equivalent to $1.16 trillion in today’s dollars. The same reduction today requires about $30 trillion of tax hikes and spending cuts by 2030.”

In his podcast, Schiff called this a “fiscal timebomb in the process of exploding.”

It’s a compounding situation. We have to borrow the money to pay that interest. Every nickel that the government pays in interest on the debt it has to borrow. All that additional borrowing adds to the national debt, which then has to be financed at a higher rate.”

If the national debt climbs to $40 trillion (and given the current deficits it won’t take long) and interest rates remain at 5% (which Jerome Powell says will be necessary to tackle inflation) interest payments on the debt alone would skyrocket around $2 trillion per year. That means that even if the US government balanced the budget so receipts covered all spending minus interest payments, we’d still be facing a $2 trillion annual deficit.

Of course, there won’t be a balanced budget. So, let’s assume the federal government can maintain the current deficit level of around $1 trillion annually (minus interest expense). Even with this overly optimistic scenario, the Treasury would be running a $3 trillion annual budget deficit. (That’s the current $1 trillion deficit plus $2 trillion in interest expenses.)

And the most likely scenario is spending will continue to climb, along with the budget deficits. There’s no telling how high the annual deficits could run.

This is a fiscal powder keg. All it needs is a match.

VIDEO: Top Globalist Announces The End Of Humanity

Source: News Wars Rephrased By: InfoArmed